|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Current Refinance Rates Florida: A Comprehensive Guide for HomeownersUnderstanding the current refinance rates in Florida is crucial for homeowners looking to optimize their mortgage terms. This guide offers insights into the factors affecting these rates and how to take advantage of them. Understanding Refinance RatesRefinance rates are influenced by several factors, including market conditions, borrower credit scores, and the type of mortgage. Staying informed can help homeowners make the best refinancing decision. Factors Affecting Refinance Rates

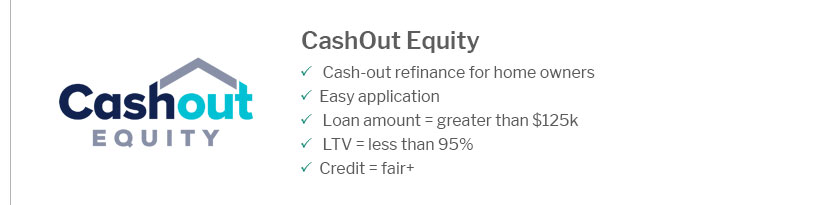

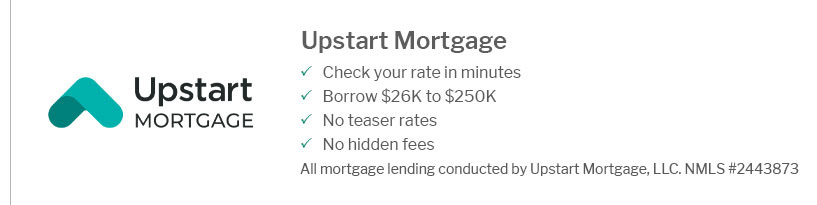

Benefits of RefinancingRefinancing can lead to lower monthly payments, reduced interest rates, and more manageable loan terms. It is an effective way to consolidate debts or free up cash for other investments. Types of Refinance OptionsHomeowners in Florida can choose from several refinancing options tailored to their financial needs. Rate-and-Term RefinanceThis is the most common type, allowing borrowers to change the interest rate, loan term, or both. It's ideal for those who want to lower their monthly payments or pay off their mortgage faster. Cash-Out RefinanceWith a cash-out refinance, homeowners can tap into their home equity, receiving a lump sum of cash for large expenses. However, it often comes with higher interest rates. Interest-Only RefinanceFor those seeking lower initial payments, an interest-only refinance allows borrowers to pay only the interest for a set period before switching to regular payments. Steps to Secure the Best Refinance Rates

Frequently Asked QuestionsWhat is the current average refinance rate in Florida?The average refinance rate in Florida varies, typically ranging from 2.5% to 3.5%, depending on market conditions and borrower qualifications. How can I qualify for a lower refinance rate?Improving your credit score, increasing your home equity, and shopping around for rates can help you secure a lower refinance rate. Is it worth refinancing in Florida right now?Refinancing can be beneficial if you can lower your interest rate by at least 1%, plan to stay in your home for several years, and can afford the associated costs. https://www.zillow.com/mortgage-rates/fl/

the rate was 5.832 percent,, and the annual percentage rate was 5.959 percent. https://www.mortgagenewsdaily.com/mortgage-rates/florida

0.750 - Down Payment and First-Time Homebuyer Programs - Offering Conventional, VA, & FHA Loans. - Online Mortgage Application and Live Agents Available - Over ... https://www.usbank.com/home-loans/mortgage/mortgage-rates/florida.html

Compare Florida mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans.

|

|---|